Call Us: (678) 400-9020

Email Us: [email protected]

Reclaiming What is Rightfully Yours.

GUARD specializes in recovering unclaimed funds and surplus proceeds from tax and mortgage foreclosures. We navigate the legal complexities so you don’t have to.

WHO WE ARE

Your Partners in Financial Recovery

GUARD is a dedicated asset recovery firm committed to helping individuals and families reclaim funds they never knew existed. When a property is sold at a foreclosure auction for more than the debt owed, the remaining balance—the surplus—belongs to the previous owner. Unfortunately, the government rarely notifies the rightful owners.

At GUARD, we act as your advocates. Our team of specialists and legal partners work tirelessly to locate these hidden assets and return them to their rightful owners before they are permanently absorbed by government agencies.

MISSION STATEMENT

Our Mission

Our mission at GUARD is to provide transparent, risk-free asset recovery services that empower our clients to reclaim their financial future. We believe in integrity, persistence, and justice, ensuring that no unclaimed fund goes ignored and no client is left behind. We don’t get paid until you do.

hOW IT WORKS

(The Process)

Our Seamless 4-Step Recovery Process

Comprehensive Research: GUARD audits government records, tax sales, and foreclosure files to identify undiscovered overages and surplus funds.

Notification: Once we verify funds are available, we reach out to you directly. We provide the proof, so you know exactly what is at stake.

Paperwork & Filing: If you choose to work with us, we handle all the legal documentation. We send the necessary forms to you for a simple signature and notarization.

Fund Disbursement: Once the claim is approved (typically 60–120 days), the funds are released. We send your check directly to you, minus our flat recovery fee.

WHY CHOOSE GUARD?

Why Work With Us?

Zero Risk: We work on a contingency basis. If we don’t recover your money, you owe us nothing.

Expert Handling: We manage the "red tape," legal filings, and county communications.

No Upfront Costs: GUARD covers all administrative and filing fees associated with your claim.

Fund Disbursement: Once the claim is approved (typically 60–120 days), the funds are released. We send your check directly to you, minus our flat recovery fee.

Transparency: You will receive regular updates on the status of your recovery.

Frequently Asked Questions

Quick answers to Our Most Common Questions

1. What are "Surplus Funds" (or Overages)?

When a property is sold at a tax or mortgage foreclosure auction, the starting bid is usually the amount of taxes or debt owed. If the property sells for more than that opening bid, the remaining money is called Surplus Funds. By law, these funds belong to the former owner or their heirs, not the government or the bank.

2. Why haven’t I been notified about this money?

While counties are required to hold these funds, they are not always proactive in finding the former owners. Often, the notification is sent to the address of the foreclosed property—which you likely no longer live at. GUARD uses specialized software and public record audits to track down these funds and find the rightful owners.

3. Is this a scam?

We understand the skepticism; this sounds "too good to be true." However, the funds are 100% real and held by the county or state. While you can technically file a claim yourself, the process involves complex legal filings, strict deadlines (often as short as 12 months in some GA counties), and potential hearings if there are other lienholders. GUARD manages the entire legal process with no upfront cost, so you don't have to navigate the "red tape" alone.

4. How much do you charge?

GUARD operates on a contingency basis. This means we only get paid a percentage of the funds we successfully recover for you. If we don’t get your money back, you owe us nothing. We cover all upfront costs, including attorney fees, filing fees, and administrative expenses.

5. How long does the recovery process take?

In Georgia, the timeline typically ranges from 60 to 120 days once the claim is filed. The speed depends on the specific county’s processing time and whether there are any competing claims from other lienholders (like a second mortgage or HOA).

6. What happens if I don't claim the money?

If the funds go unclaimed for a certain period (usually 5 years in Georgia), they are transferred to the State Department of Revenue as "unclaimed property." Once this happens, the process to recover them becomes significantly more difficult and time-consuming. It is always best to act as soon as possible after a sale.

7. My family member owned the property but has passed away. Can I still claim the funds?

Yes. If you are a legal heir or the executor of an estate, you are entitled to claim the funds. GUARD has experience working with probate and estate cases to ensure the money stays within the family.

Testimonials

John Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Jane Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Don’t Let the Government Keep Your Money.

Every year, millions of dollars in surplus funds go unclaimed and are eventually lost to the state. Time is often a factor. Let GUARD start the recovery process for you today.

Phone:

(678) 400-9020

Email:

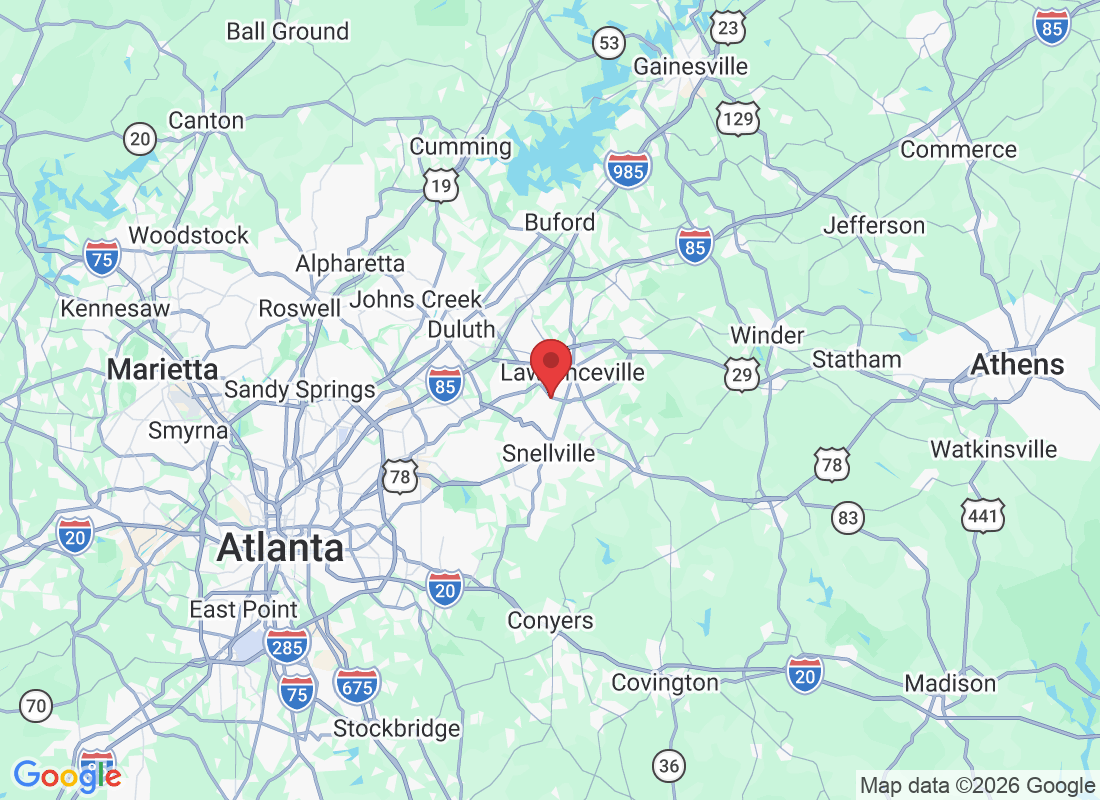

GEORGIA COUNTIES

© Copyright 2026. CountyAssets.com

All rights reserved.